Navigating SEC Cybersecurity Disclosure Requirements: Ensuring Compliance and Building Trust

Maria Jose Castro L

Nov 25, 2024

The U.S. Securities and Exchange Commission (SEC) has implemented new cybersecurity disclosure rules to enhance transparency and accountability among public companies. These rules require timely reporting of material cybersecurity incidents, governance practices, and risk management strategies to provide investors with relevant insights. Effective December 2023, the regulations emphasize the critical role of cybersecurity in corporate governance and business strategy, requiring companies of all sizes—including smaller reporting companies (SRCs)—to adopt robust compliance measures.

Key Findings

- Cybersecurity risks are increasingly material to investor decision-making, driving the need for standardized disclosures

- Many companies lack integrated processes for assessing materiality and ensuring timely incident reporting

- Smaller reporting companies face unique challenges but are equally subject to these new requirements

48% of public companies lack a dedicated Chief Information Security Officer (CISO) or internal cybersecurity team, exposing them to heightened risks and vulnerabilities.

Call to Action

Organizations must act swiftly to adapt to the SEC’s stringent requirements by:

- Investing in robust cybersecurity infrastructure and governance frameworks.

- Aligning internal and external processes to enable rapid assessment and disclosure of material incidents.

- Collaborating across IT, legal, and compliance teams to ensure readiness.

Introduction

The U.S. Securities and Exchange Commission (SEC) adoption of rules on Cybersecurity Risk Management, Strategy. Governance, and Incident Disclosure for public companies is a major regulatory update designed to enhance transparency and accountability regarding cybersecurity practices. The SEC mandates that all public companies subject to the reporting requirements of the SEC Exchange Act of 1934 comply with its updated cybersecurity disclosure rules, including a) Domestic Public Companies and b) Foreign Private Issuers.

All public companies listed on U.S. exchanges, regardless of industry or size, must comply with SEC cybersecurity disclosure requirements. However, they are only obligated to disclose incidents that meet the materiality threshold—meaning those with the potential to significantly impact the company’s financial position, reputation, or operations. As SEC Chair Gary Gensler explained, “Whether a company loses a factory in a fire — or millions of files in a cybersecurity incident — it may be material to investors.”

Typically, the responsibility for determining materiality lies with the company’s legal and compliance teams, who assess whether an incident warrants disclosure. At this stage, close collaboration with the cybersecurity team is crucial. The cybersecurity team provides essential insights into the incident’s scope, severity, and potential operational impact, supplying the legal and compliance teams with the technical information needed for a well-informed materiality assessment. This partnership ensures that all aspects of the incident—both technical and regulatory—are thoroughly evaluated, leading to an accurate and comprehensive disclosure decision.

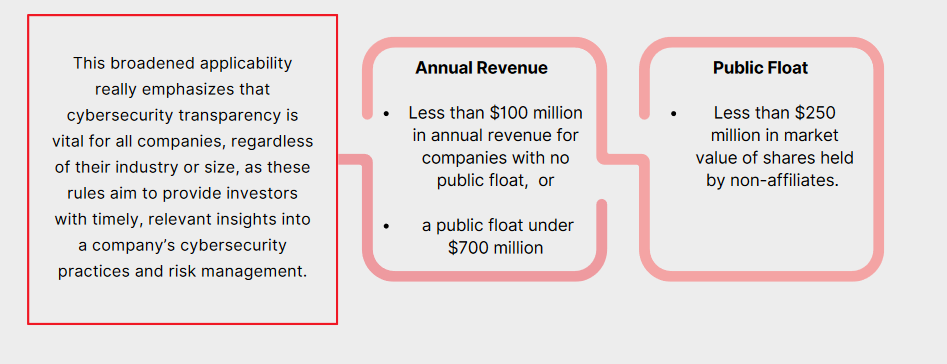

A notable aspect of the SEC’s push is the application to smaller reporting companies (SRC’s). Asnoted by the commission on their report, “Smaller companies may face equal or greater cybersecurity risk than larger companies, such that cybersecurity disclosures may be particularly important for their investors.” An SRC must satisfy one of the following:

SEC Requirements

The SEC’s new cybersecurity disclosure rules for public companies, aim to provide investors with timely, relevant insights into companies’ cybersecurity practices and incident management. These rules are part of a larger initiative to increase transparency at a time when cybersecurity risks have become central to a company’s operations, reputation, and financial well-being.

Objective of the Requirements

The SEC’s new rules aim to provide clarity and timely information on cybersecurity risk and management practices. By standardizing the disclosure of cybersecurity incidents and governance, it seems that the SEC intends to increase investor confidence and ensure that material cybersecurity risks are made visible. Companies that fail to comply with these requirements may face enforcement actions, penalties, and reputational consequences.

These updated cybersecurity disclosure requirements underscore the increasing importance of cybersecurity as a critical component of both business strategy and corporate governance. By mandating transparency in how companies address cybersecurity risks and respond to incidents, the SEC aims to reinforce accountability at the highest levels. This ensures that boards and executives play an active role in decision-making during cybersecurity risk management and incident response, while providing investors with clearer insights into how companies are protecting sensitive data and responding to potential threats.

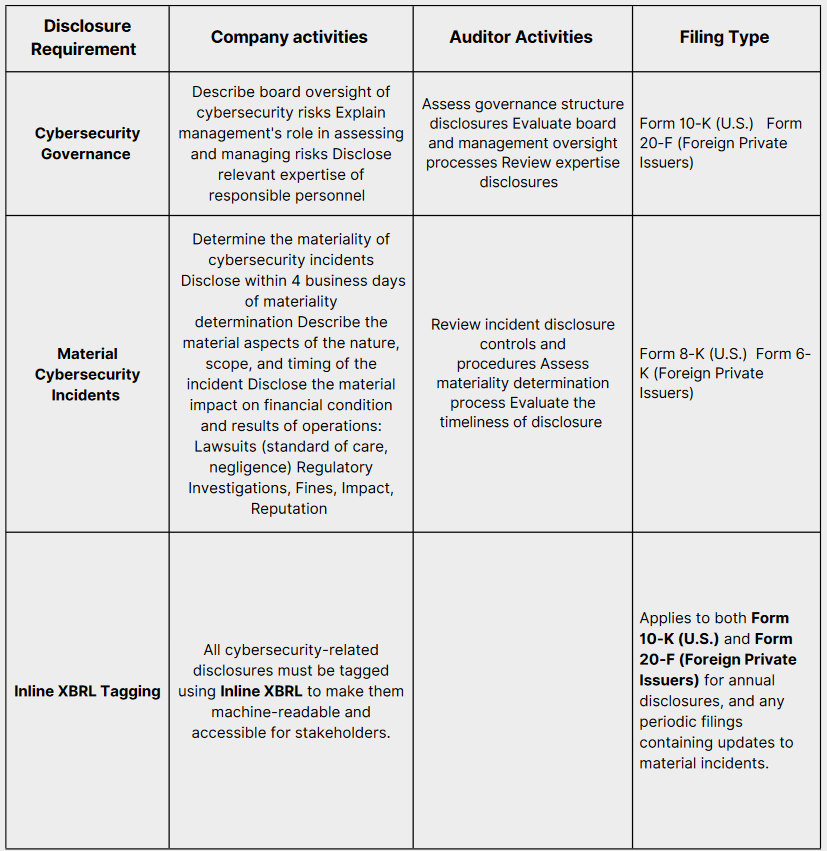

The SEC’s new rules require (1) annual disclosures in Form 10-K regarding the company’s processes, if any, for identifying, assessing and managing material risks from cybersecurity threats as well as management’s and the board’s roles in managing and overseeing material cybersecurity risks; and (2) that public companies disclose on Form 8-K material cybersecurity incidents within four business days of determining their materiality. . These measures aim to enhance clarity and give investors timely relevant information regarding the company’s standpoint in cybersecurity and incidents.

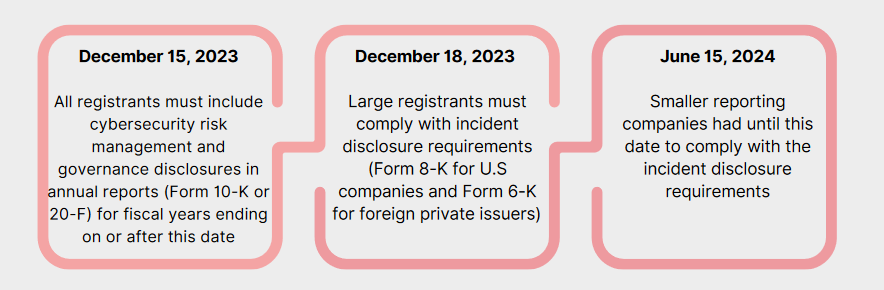

Regarding the effective date for the cybersecurity requirements, the SEC’s final rule on these disclosures went into effect on September 5, 2023, however, the compliance dates were staggered:

Here is a quick table review of the latest SEC requirements:

Teams Involved in Cybersecurity Disclosures

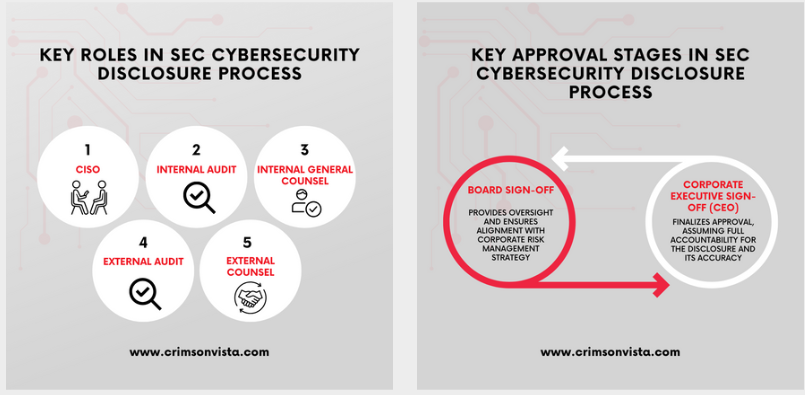

In the SEC's cybersecurity disclosure process, several internal and external teams play essential roles, each contributing to different aspects of assessing, determining, and managing disclosures.

Conclusion

In conclusion, the SEC's updated cybersecurity disclosure requirements underscore the critical roleof transparency, accountability, and governance in today’s business landscape. By mandating timely and detailed disclosures, the SEC ensures that investors are better informed about the cybersecurity practices and incident response strategies of public companies, as they are equally important as other financial and business decisions. This regulatory push highlights that cybersecurity is not only a technical issue but a key element of business strategy and corporate governance, with board members and executives expected to play an active role.

The structured disclosure process—starting from incident assessment by the CISO and internal audits, to materiality evaluation by legal, and validation by external auditors—ensures that each cybersecurity incident is addressed accurately and responsibly. This collaborative approach ultimately supports investor confidence and positions companies to address cybersecurity risks as integral to their resilience and reputation, reflecting the SEC’s aim to protect stakeholders in an increasingly digital world.